Understanding HSA and FSA Coverage for Weight Loss

Thinking about using your Health Savings Account (HSA) or Flexible Spending Account (FSA) to cover weight-loss medication or programs? It's understandable to feel confused—the rules can be complicated. This guide provides clear, actionable steps to help you navigate the process successfully.

HSA vs. FSA: Key Differences

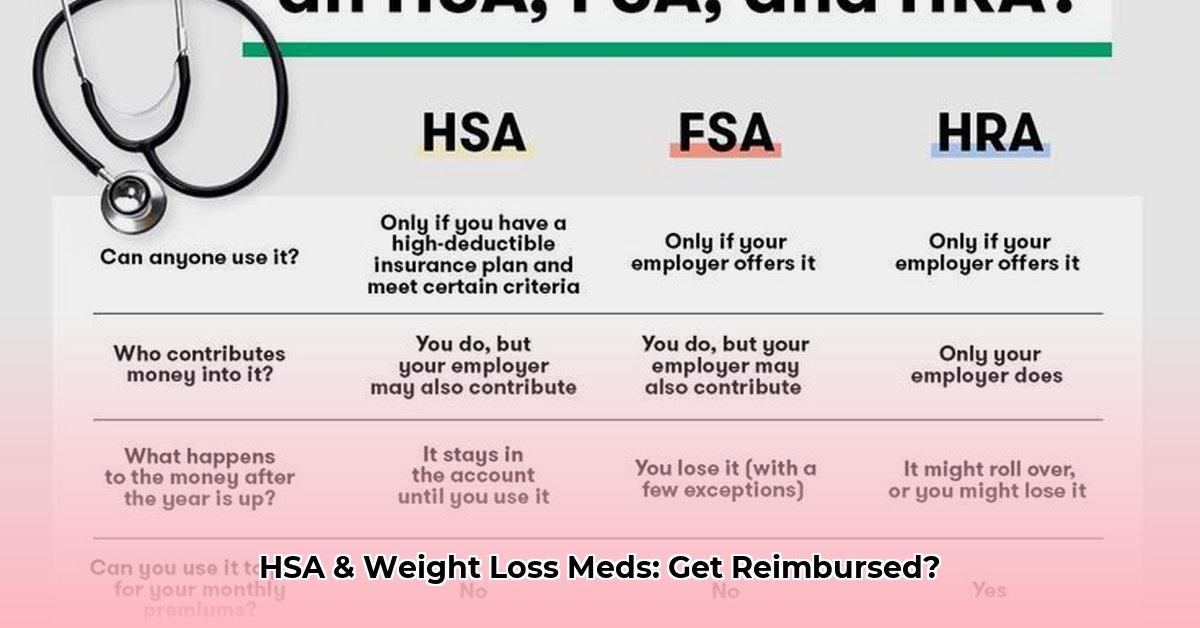

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) both help pay for healthcare costs, but they differ significantly:

- HSAs: These are personal savings accounts with pre-tax contributions that roll over year to year. They're best for long-term health savings.

- FSAs: Typically offered through employers, FSA funds are usually allocated annually and expire at the end of the year.

This difference impacts how you might use them for weight-loss treatments. HSAs offer greater flexibility for long-term weight management strategies.

The Decisive Factor: Medical Necessity

The key to HSA/FSA coverage for weight loss is medical necessity. This means your doctor must determine that weight loss is crucial for treating a specific medical condition, not just for general well-being. Conditions like type 2 diabetes, high blood pressure, or sleep apnea often benefit from medically supervised weight loss.

A Letter of Medical Necessity (LOMN) from your doctor is essential. This letter formally documents your medical condition and explains why weight loss is a vital part of your treatment plan. Without it, reimbursement is unlikely.

What Might Be Covered?

With a valid LOMN, these expenses might be covered (always check your plan details):

- Prescription Weight-Loss Medications: Only if prescribed by a doctor as part of a treatment plan for a diagnosed medical condition.

- Medically Supervised Weight-Loss Programs: Programs with medical oversight, including dietary guidance and exercise plans, may be eligible.

- Registered Dietitian Consultations: Consultations for personalized meal plans, when part of a broader medical treatment plan.

What's Generally Not Covered?

Many weight-loss approaches are usually not covered:

- Gym Memberships: Unless explicitly prescribed by your doctor as therapy for a specific medical condition.

- Over-the-Counter Weight-Loss Supplements: These are considered elective and not part of a medically necessary treatment.

- General Wellness Programs: Programs aimed at overall health improvement, without a diagnosed condition, are generally not eligible.

A Step-by-Step Guide to Maximizing Your HSA/FSA Benefits

Follow these steps to increase your chances of reimbursement:

- Consult Your Doctor: Discuss your weight, health concerns, and weight-loss goals. Determine if weight loss is medically necessary for treating an existing condition.

- Obtain the LOMN: If weight loss is medically necessary, request an LOMN outlining your condition, treatment plan, and the importance of weight loss.

- Review Your Plan Documents: Carefully review your HSA or FSA plan’s coverage details. Note specific guidelines for weight-loss treatments.

- Maintain Detailed Records: Keep all receipts, doctor's notes, the LOMN, and any communication with your plan administrator.

- Submit Claims Accurately: Follow your plan's claim submission procedures diligently. Include all necessary documentation.

Weighing the Pros and Cons: HSA/FSA for Weight Loss

| Feature | Pros | Cons |

|---|---|---|

| Tax Advantages | Pre-tax contributions save money. | Requires thorough documentation and plan adherence. |

| Potential Coverage | Can cover medically necessary weight-loss interventions. | Limited to medically necessary treatments; many common methods are excluded. |

| Account Flexibility | HSAs offer greater flexibility than FSAs (funds usually expire annually). | Strict eligibility criteria and a need for physician approval. |

Important Note: IRS regulations change. Verify current information with your plan administrator and consult the IRS website ([1]: https://www.irs.gov/publications/p503) for the most up-to-date details. Remember, the focus is on managing a medical condition through medically necessary weight loss, not general weight reduction.

Key Takeaways: HSA/FSA coverage hinges on medical necessity, documented by your doctor’s LOMN. Always check your plan’s specific rules. Keep thorough records to support your claims. Proactive communication with your doctor and plan administrator is key to successful reimbursement.